California Nanotechnologies Announces Q1 2026 Results

Jul 30, 2025

- Quarterly revenue of US$717K with significant improvements to customer concentration

- Adjusted EBITDA1 loss of US$151K and Positive Cash Flow from Operations of US$72K

- Manufacturing revenues excluding “green steel” customer increased US$350K or 156% YOY

TSX VENTURE: CNO

OTCMKTS: CANOF

LOS ANGELES, CALIFORNIA, July 30, 2025 - California Nanotechnologies Corp. ("Cal Nano" or the "Company") is pleased to announce revenues of US$716,553 for the quarter ended May 31, 2025. This represents a decrease of 59% compared to the prior year. Adjusted EBITDA[1] was a loss of US$152,707 for the fiscal quarter ended May 31, 2025, compared with positive Adjusted EBITDA of US$754,467 in the prior year.

Net loss for the fiscal quarter was US$447,887, compared to net income of US$696,042 in the prior fiscal year. The lower net income was mainly due to the lower revenues and gross profit, higher overhead from the Santa Ana manufacturing facility, and growth investments such as the recently announced ISO9001 certification. The previous year’s fiscal quarter also benefited from a US$141,829 non-cash, unrealized gain on share purchase warrants[2].

Diluted earnings per share for the fiscal year was $0.00 compared to diluted earnings per share of $0.01 for the same period last year. The financial statements are available on SEDAR+ at www.sedarplus.ca and on the Company’s website.

“This quarter was impacted by a reduction in revenues from our green steel customer as previously disclosed,” stated CEO Eric Eyerman. “In recent quarters, we have pursued efforts to diversify our customer base and transition to longer-term recurring commercial contracts. We saw progress from this initiative with manufacturing revenues, excluding the green steel client, growing 156% year-over-year and customer concentration down significantly. We expect revenue improvements in subsequent quarters as we ramp up business with existing customers and bring new ones online, with whom we are in advanced discussions.”

The decrease in revenues for Q1/FY2026 was primarily driven by both the slowdown in the green steel customer and a reduction in equipment deliveries. Revenues from the green steel customer and equipment deliveries were US$144,198, for the fiscal quarter, representing 20% of revenues. This is compared to US$1,526,410 for the same quarter in the prior fiscal year, representing 87% of revenues.

Manufacturing revenues from all other customers were US$572,355, representing a 156% increase year-over-year and showcases the Company’s efforts to build a more resilient revenue base. While we cannot predict when or if the green steel customer will resume their previous level of activities, Cal Nano is focused on improving the overall utilization of equipment and contribution margin with a larger portfolio of customers.

As previously announced in April 2025, Cal Nano secured its first commercial production orders for its cryomilling technologies with Oerlikon Metco (US) Inc. and AbTech Industries Inc. Since the announcement, the Company has successfully delivered the first batches of product and expects to receive subsequent purchase orders from both companies. In addition, Cal Nano is in advanced discussions with existing and new customers for commercial production mandates spanning the automotive, defense, energy, and industrial sectors.

For the remainder of FY2026, Cal Nano believes that it is well positioned to support potential growth with its key investments in personnel, capabilities, and over US$2 million in recent equipment purchases. As a result, the Company expects that Q2/FY2026 will show progress in the diversification and growth strategy, and result in improved revenue and adjusted EBITDA over Q1/FY2026.

Financial Highlights

|

Amounts in USD |

Three months ended May 31, 2025 |

Three months ended May 31, 2024 |

Period-over-period change |

|

Revenues |

716,553 |

1,748,826 |

(59%) |

|

Cost of Goods Sold |

308,492 |

599,153 |

(49%) |

|

Gross Profit |

408,061 |

1,149,673 |

(64%) |

|

Gross Margin1 |

57% |

65% |

(800bps) |

|

Net Income/(Loss) |

(447,887) |

696,042 |

(164%) |

|

Income/(loss) Per Share –Diluted |

$0.00 |

$0.02 |

- |

|

Cash Flow from/(for) Operations |

71,589 |

(283,520) |

125% |

|

EBITDA1 |

(247,021) |

874,941 |

(128%) |

|

Adjusted EBITDA1 |

(152,707) |

754,467 |

(120%) |

About California Nanotechnologies Corp.

At Cal Nano, we envision a world in which our advanced technologies are used to help make the most innovative products on this planet and beyond. With our unique expertise in processing metallurgic powders into parts, global leaders trust us to help push the boundaries of applied material science. Headquartered in Greater Los Angeles, California, Cal Nano hosts advanced processing and testing machinery and capabilities across two manufacturing facilities for materials research and production needs. Our customers range from Fortune 500 companies to startups with programs spanning aerospace, renewable energy, defense, and semiconductors.

For further information, please contact:

California Nanotechnologies Corp.

Eric Eyerman, CEO

T: +1 (562) 991-5211

info@calnanocorp.com

Panolia Investor Relations Inc.

Brandon Chow, Principal & Founder

T: +1 (647) 598-8815

brandon@panoliair.com

Non-IFRS Measures and Reconciliation of Non-IFRS Measures

This press release makes reference to certain non-IFRS measures. These non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing a further understanding of results of operations of Cal Nano from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the financial information of Cal Nano reported under IFRS. The Company uses non-IFRS measures such as EBITDA to provide investors with a supplemental measure of operating performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess the Company’s ability to meet its capital expenditure and working capital requirements.

“EBITDA” means the earnings before interest, income taxes, depreciation, and amortization, where interest is defined as net finance costs as per the consolidated statement of comprehensive income.

“EBITDA margin” means the earnings before interest, income taxes, depreciation, and amortization, where interest is defined as net finance costs as per the consolidated statement of comprehensive income as a percentage of total revenues.

"Adjusted EBITDA" refers to earnings before interest, income taxes, depreciation, amortization, share-based compensation, and the unrealized gain on share purchase warrants, with interest defined as net finance costs as per the consolidated statement of comprehensive income.

"Adjusted EBITDA margin" refers to earnings before interest, income taxes, depreciation, amortization, share-based compensation, and the unrealized gain or loss on share purchase warrants, with interest defined as net finance costs as per the consolidated statement of comprehensive income as a percentage of total revenues.

Reconciliations and Calculations

The tables set forth below provides a quantitative reconciliation of Gross Margin and EBITDA, which are Non-IFRS financial measures, to the most comparable IFRS measure disclosed in the Company’s financial statements. The reconciliation of Non-IFRS measures to the most directly comparable measure calculated in accordance with IFRS is provided below where appropriate.

Gross Margin Reconciliation

|

Amounts in USD |

Three months ended May 31, 2025 |

Three months ended May 31, 2024 |

|

Revenues |

716,553 |

1,748,826 |

|

Cost of Goods Sold |

308,492 |

599,153 |

|

Gross Profit |

408,061 |

1,149,673 |

|

Gross Margin |

57% |

65% |

EBITDA and Adjusted EBITDA Reconciliation

|

Amounts in USD |

Three months ended May 31, 2025 |

Three months ended May 31, 2024 |

|

Net Income/(Loss) |

(447,887) |

696,042 |

|

Depreciation & Amortization |

173,635 |

115,547 |

|

Interest Expense |

27,231 |

63,352 |

|

Income Tax Expense |

- |

- |

|

EBITDA |

(247,021) |

874,941 |

|

EBITDA Margin |

(34%) |

50% |

|

Share-based Compensation |

95,566 |

21,355 |

|

Loss/(Gain) on Share Purchase Warrants |

(1,252) |

(141,829) |

|

Adjusted EBITDA |

(152,707) |

754,467 |

|

Adjusted EBITDA Margin |

(21%) |

43% |

Derivative Liability Recognition for Warrant Issuance under IFRS

On October 30, 2023, the Company successfully closed an issuance of units comprising common shares and warrants, encompassing an aggregate of 5,000,000 warrants, each with an exercise price of CA$0.25. As a result of the Company reporting its financial results denominated in US dollars, and in adherence to the International Financial Reporting Standards (IFRS), the Company is required to report a derivative liability attributable to the aforementioned warrants. Consequently, the Company will recognize a non-cash charge or income inclusion on a quarterly basis, predicated upon the fluctuation in the market price of the Company’s shares, until such time as the warrants either are exercised or expire.

Reader Advisory

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. In particular, forward-looking information in this press release includes, but is not limited to: future financial results, including anticipated profitability and/or lack thereof; statements about future plans, including statements about the planned expansion of the Company’s manufacturing capacity, and new sites for the Company’s production and headquarters; demand for the Company’s services by current and future customers, including existing and future orders for the Company’s SPS equipment and the anticipated revenue therefrom; and the expected future performance of the Company. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; a significant change in demand for the Company’s services and products; industry conditions, governmental regulation, including environmental regulation; the effects of product development and need for continued technological change; the effect of government regulation and compliance on the Corporation and the industry; research and development risks; reliance on key personnel; operations in foreign jurisdictions; protection of intellectual property rights; contractual risk; third-party risk, risk of technological or scientific obsolescence; dependence of technical infrastructure; unanticipated operating events or performance; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] Non-IFRS Measure

[2] See disclosure under “Derivative Liability Recognition for Warrant Issuance under IFRS”

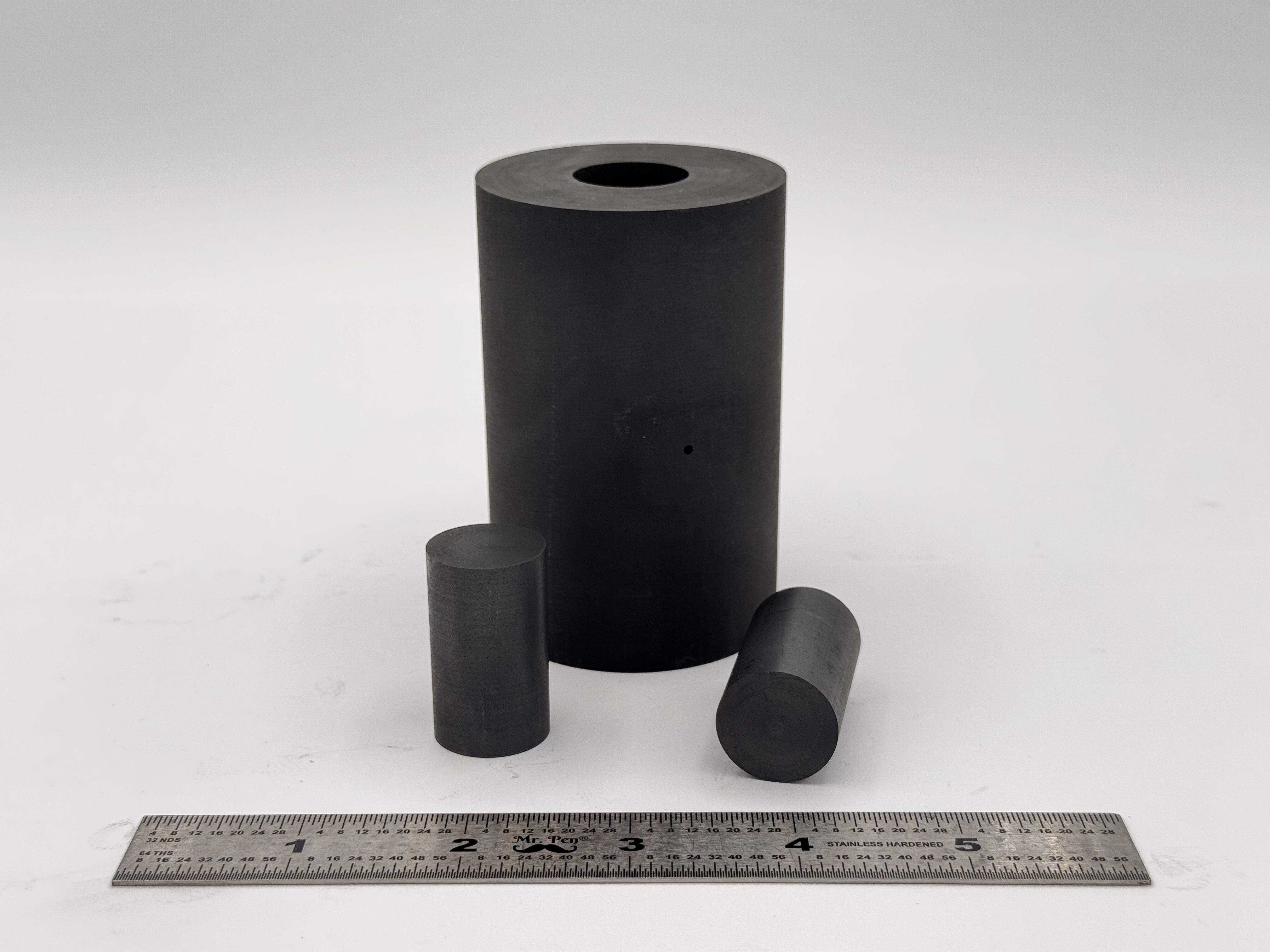

High Strength SPS Graphite Tooling

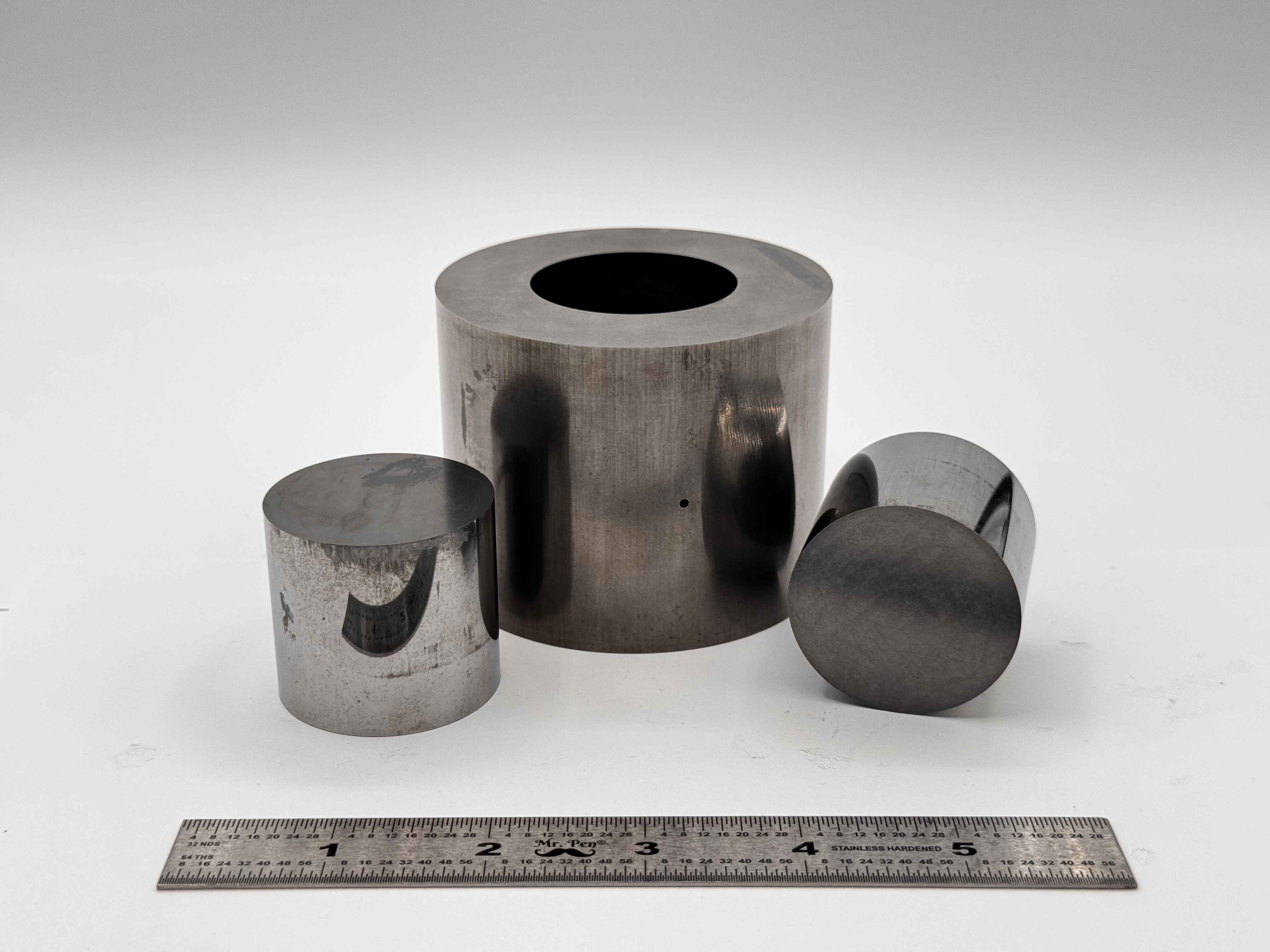

High Strength SPS Graphite Tooling Tungsten Carbide Tooling

Tungsten Carbide Tooling Carbon Graphite Foil / Paper

Carbon Graphite Foil / Paper Carbon Felt and Yarn

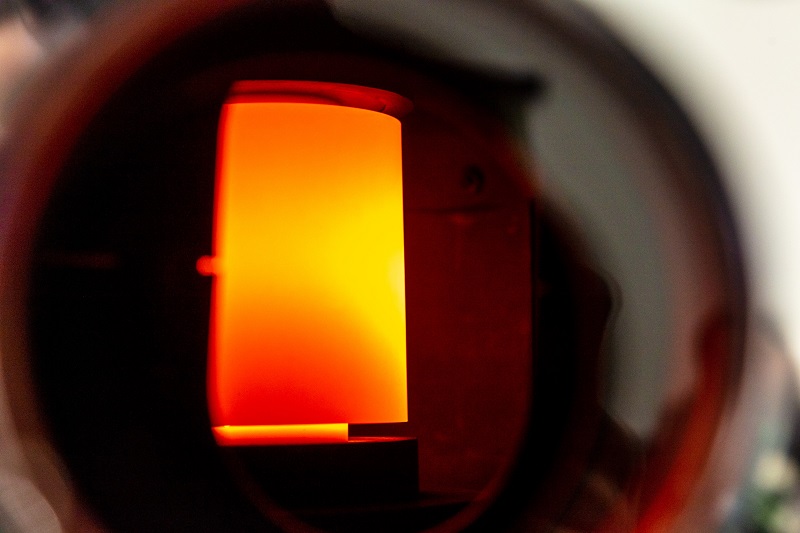

Carbon Felt and Yarn Spark Plasma Sintering Systems

Spark Plasma Sintering Systems SPS/FAST Modeling Software

SPS/FAST Modeling Software