California Nanotechnologies Announces Non-Brokered Private Placement and Shares for Debt Exchange

Sep 14, 2023

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

TSX VENTURE: CNO

OTCMKTS: CANOF

LOS ANGELES, CALIFORNIA, September 14, 2023 – California Nanotechnologies Corp. (“Cal Nano” or the “Company”) is pleased to announce that it intends to complete a non-brokered private placement of up to 8,333,333 units of the Company (the “Units“) at a price of C$0.15 per Unit for total gross proceeds to the Company of up to C$1,250,000 (the “Offering“). The Offering is subject to an over-allotment option allowing the Company to increase the Units sold by an additional 1,666,667 Units for additional proceeds of C$250,000, if fully exercised (the “Over-Allotment Option”). Each Unit will be comprised of one (1) common share in the capital of the Company (each, a “Common Share”) and one half (0.5) of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant shall be exercisable to acquire one (1) additional Common Share at an exercise price of C$0.25 for two years from the closing of the Offering.

The Company intends to use the net proceeds raised from the Offering for general working capital and corporate purposes. The Offering is subject to the receipt of all necessary regulatory and other approvals, including the receipt of approval from the TSX Venture Exchange (the “TSXV”). Finder’s fees may be payable in connection with the Offering.

The securities in the Offering will be offered by way of the “listed issuer” exemption under National Instrument 45-106 – Prospectus Exemptions in all the provinces of Canada with the exception of Quebec (the “Selling Jurisdictions”). The securities are expected to be immediately freely tradeable under applicable Canadian securities legislation if sold to purchasers resident in Canada, other than securities acquired by insiders which shall be subject to a hold period of four months pursuant to TSXV policies. An offering document related to the Offering that can be accessed under the Company’s profile at www.sedarplus.ca and at the Company’s website at www.calnanocorp.com will be filed in the next three business days, and the Company will not solicit an offer to purchase securities under the Offering until the offering document is posted. Prospective investors should read this offering document before making an investment decision. Prospective investors may contact info@calnanocorp.com for more information about the Offering once the offering document has been published.

In addition, the Company is expecting to settle pre-existing debt under an existing loan facility for intercorporate debt (the “Debt Settlement”) with Omni-Lite Industries Canada Inc. (“Omni-Lite”), such debt being described in the Company’s news releases dated September 12, 2023, January 31, 2023, and May 24, 2022. The Company expects to cancel up to $180,000 of debt owing to Omni-Lite through the issuance of up to 1,200,000 Common Shares at a deemed price of C$0.15, assuming the Offering is fully subscribed and the Over-Allotment Option is exercised in full. The Debt Settlement is expected to assist the Company with preserving its cash, and management believes the Debt Settlement is in the best interests of the Company. Completion of the Debt Settlement is subject to all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

Eric Eyerman, the Chief Executive Officer of the Company is also expected to participate in the Offering by purchasing 2,250,000 Units at a price of C$0.15 (US$0.10) per Unit for aggregate gross proceeds of C$333,333 (US$250,000). The proceeds for Mr. Eyerman’s participation in the Offering are expected to be advanced by the Company (the “Advancement”), as approved by the shareholders at the shareholder meeting of the Company held on August 23, 2023. Mr. Eyerman’s participation in the Offering is expected to align management incentives with that of the shareholders, and management believes the Advancement is in the best interests of the Company. Completion of the Advancement is subject to all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

Certain insiders of the Company (the “Offering Insiders”) may acquire securities under the Offering, with the expected Insider participation being at least 25% of the Offering. In addition, Omni-Lite is entering into the Debt Settlement. Any such participation by Offering Insiders and Omni-Lite will be considered to be a "related party transaction" as defined under the policies of the TSXV and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company anticipates relying on exemptions from the minority shareholder approval and formal valuation requirements applicable to the related-party transactions under sections 5.5(a) and 5.7(1)(a), respectively, of MI 61-101, as neither the fair market value of the securities to be acquired by the Offering Insiders and Omni Lite, nor the consideration to be paid by such Offering Insiders and Omni-Lite is anticipated to exceed 25% of the Company's market capitalization.

The securities described herein have not been, and will not be, registered under the U.S. Securities Act, or any state securities laws, and accordingly may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This press release does not constitute an offer to sell or a solicitation to buy any securities in any jurisdiction.

About California Nanotechnologies Corp.

At Cal Nano, we envision a world in which our advanced technologies are used to help make the most innovative products on this planet and beyond. We are trusted by global leaders to help push the boundaries of applied material science by utilizing our unique technical expertise and vision. Headquartered in Los Angeles, California, Cal Nano hosts a complement of advanced processing and testing capabilities for materials research and production needs. Customers range from Fortune 500 companies to startups with programs spanning aerospace, renewable energy, defense, and semiconductors.

For more information:

California Nanotechnologies Corp.

Eric Eyerman, CEO

T: +1 (562) 991-5211

info@calnanocorp.com

Otis Investor Relations Inc.

Brandon Chow, Principal & Founder

T: +1 (647) 598-8815

brandon@otisir.com

Reader Advisory

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. In particular, forward-looking information in this press release includes, but is not limited to the expected future performance of the Company, the anticipated Offering, including the maximum size thereof, the expected timing to complete the Offering, the exercise of the over-allotment option for the Offering, the ability to complete the Offering on the terms provided herein or at all, the anticipated use of the net proceeds from the Offering and the receipt of all necessary approvals, including the approval of the TSXV (and the timing thereof). Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, governmental regulation, including environmental regulation; unanticipated operating events or performance; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities, including approval for the Offering; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

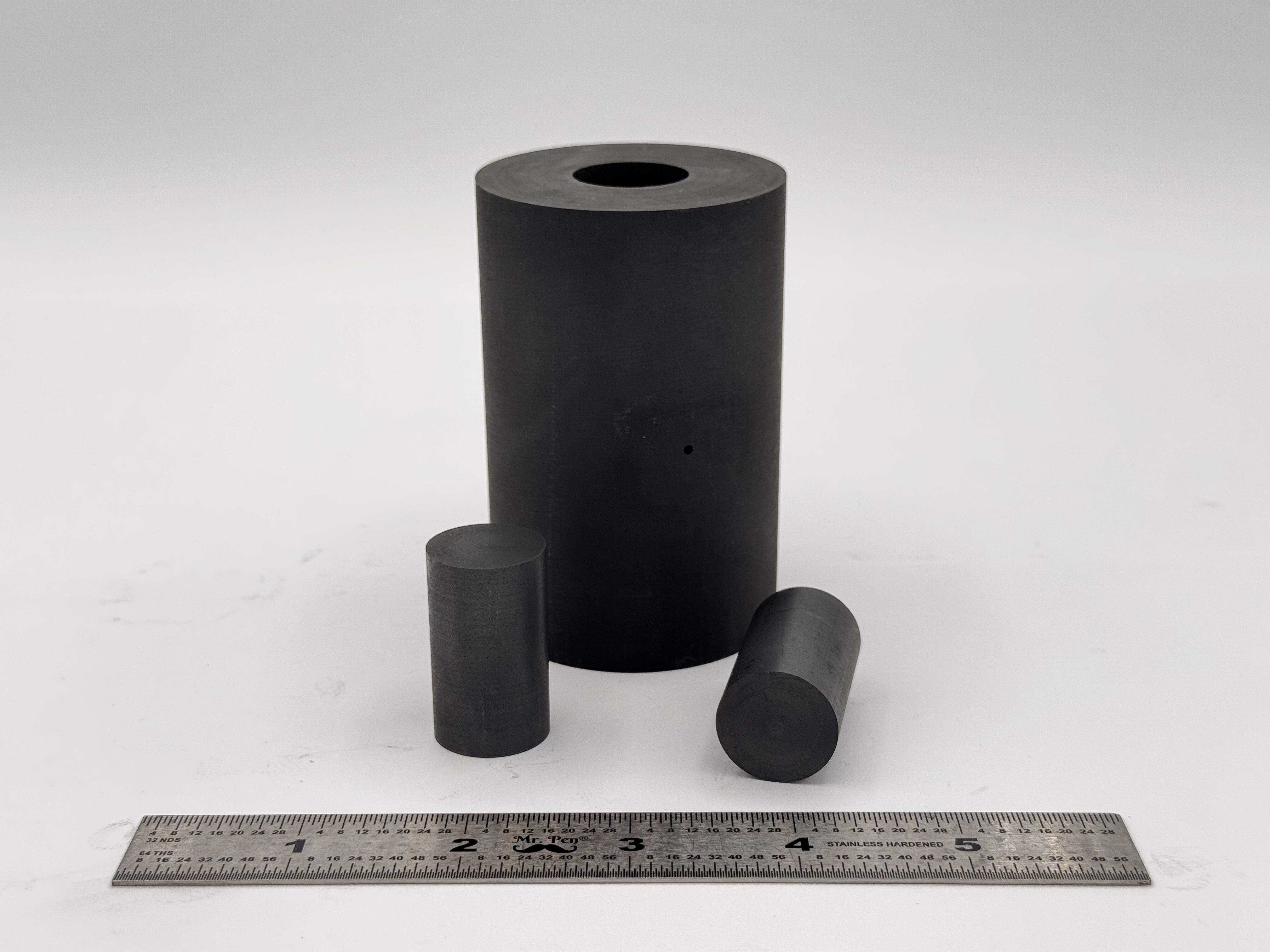

High Strength SPS Graphite Tooling

High Strength SPS Graphite Tooling Tungsten Carbide Tooling

Tungsten Carbide Tooling Carbon Graphite Foil / Paper

Carbon Graphite Foil / Paper Carbon Felt and Yarn

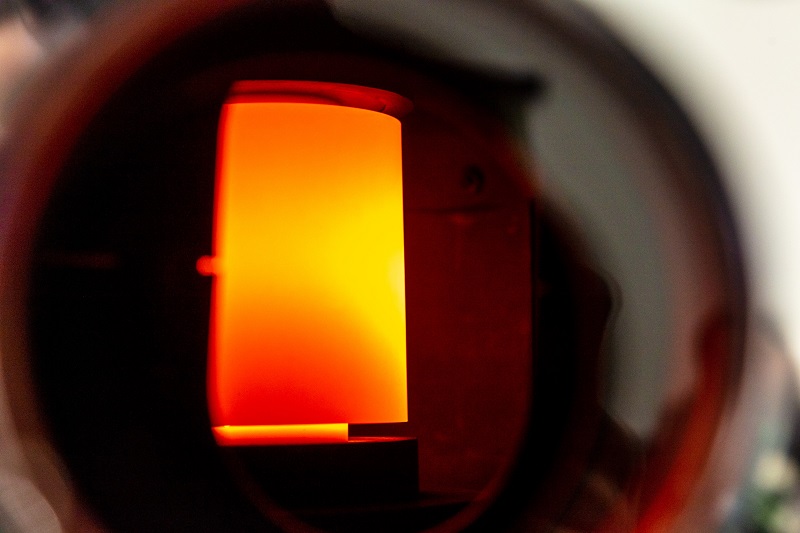

Carbon Felt and Yarn Spark Plasma Sintering Systems

Spark Plasma Sintering Systems SPS/FAST Modeling Software

SPS/FAST Modeling Software