California Nanotechnologies Announces Closing of Non-Brokered Private Placement and Shares for Debt Exchange

Oct 30, 2023

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

TSX VENTURE: CNO

OTCMKTS: CANOF

LOS ANGELES, CALIFORNIA, October 30, 2023 – California Nanotechnologies Corp. (“Cal Nano” or the “Company”) is pleased to announce the closing of its previously-announced non-brokered private placement for aggregate gross proceeds of C$1,500,000.00 (the “Offering“). Under the Offering, the Company sold 10,000,000 Units of the Company (each, a “Unit”), which included full exercise of the over-allotment option, at a price of C$0.15 per Unit.

Each Unit consists of one (1) common share in the capital of the Company (each, a “Common Share”) and one half (0.5) of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant shall entitle the holder to acquire one (1) additional Common Share at an exercise price of C$0.25 at any time on or before October 30, 2025.

The securities in the Offering were offered by way of the “listed issuer” exemption under National Instrument 45-106 – Prospectus Exemptions (the “Listed Issuer Financing Exemption“) in all of the provinces of Canada, with the exception of Quebec. The Common Shares and Warrants underlying the Units are freely tradeable and are not subject to a hold period pursuant to applicable Canadian securities laws.

The Company intends to use the net proceeds of the Offering for growing its customer base, acquisitions of equipment and expansion of capacity, and for general corporate and working capital purposes, as further described in the Company’s offering document under the Listed Issuer Financing Exemption dated September 14, 2023. The Offering is subject to the receipt of all necessary regulatory and other approvals, including the receipt of final approval from the TSX Venture Exchange (the “TSXV”). Finder’s fees in the aggregate cash amount of C$22,673.50, equivalent to 5.5% of the gross proceeds of certain subscriptions under the Offering, were paid to eligible finders. No finder’s warrants or similar securities were issued in connection with the Offering.

In addition, the Company is pleased to announce the closing of the previously announced shares for debt settlement (the “Debt Settlement”) with Omni-Lite Industries Canada Inc. (“Omni-Lite”), as described in the Company’s news releases dated September 12, 2023, January 31, 2023, May 24, 2022, and September 14, 2023. The Company cancelled C$180,000 of debt owing to Omni-Lite through the issuance of 1,200,000 Common Shares at a deemed price of C$0.15. The Debt Settlement is subject to the receipt of all necessary regulatory and other approvals, including the receipt of final approval from the TSXV. Following the Debt Settlement, Omni-Lite now owns or controls an aggregate of 7,204,970 Common Shares, representing approximately 16.6% of the Company’s issued and outstanding shares on a fully and partially diluted basis. In satisfaction of the requirements of National Instrument 62-104 – Take-Over Bids and Issuer Bids and National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues, an early warning report respecting the acquisition of Common Shares by Omni-Lite will be filed under the Company’s SEDAR+ Profile at www.sedarplus.ca. The acquisition of Common Shares was completed for investment purposes. Depending on market and other conditions, Omni-Lite may from time to time in the future increase or decrease their ownership, control or direction over securities of the Company, through market transactions, private agreements, or otherwise.

Eric Eyerman, Roger Dent, and Sebastien Goulet (the “Offering Insiders”) purchased an aggregate of 3,586,666 Units under the Offering, representing approximately 35.9% of the Offering. In addition, Omni-Lite has received 1,200,000 Common Shares in connection with the Debt Settlement. The issuance of securities to Offering Insiders and Omni-Lite is considered a "related party transaction" as defined under the policies of the TSXV and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is relying on exemptions from the minority shareholder approval and formal valuation requirements applicable to the related party transactions under sections 5.5(a) and 5.7(1)(a), respectively, of MI 61-101, as neither the fair market value of the securities to be acquired by the Offering Insiders and Omni Lite, nor the consideration to be paid by such Offering Insiders and Omni-Lite exceeds 25% of the Company's market capitalization. The securities issued to the Offering Insiders and Omni-Lite will be subject to a hold period of four months and one day in accordance with the policies of the TSX Venture Exchange (the “TSXV”). The Company did not file a material change report containing all of the disclosure required by MI 61-101 more than 21 days before the expected closing date of the Offering and Debt Settlement as the aforementioned insider participation had not been confirmed at that time, and the Company wished to close the Offering and Debt Settlement as expeditiously as possible.

The securities described herein have not been registered under the U.S. Securities Act, or any state securities laws, and accordingly may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This press release does not constitute an offer to sell or a solicitation to buy any securities in any jurisdiction.

About California Nanotechnologies Corp.

At Cal Nano, we envision a world in which our advanced technologies are used to help make the most innovative products on this planet and beyond. We are trusted by global leaders to help push the boundaries of applied material science by utilizing our unique technical expertise and vision. Headquartered in Los Angeles, California, Cal Nano hosts a complement of advanced processing and testing capabilities for materials research and production needs. Customers range from Fortune 500 companies to startups with programs spanning aerospace, renewable energy, defense, and semiconductors.

For more information:

California Nanotechnologies Corp.

Eric Eyerman, CEO

T: +1 (562) 991-5211

info@calnanocorp.com

Otis Investor Relations Inc.

Brandon Chow, Principal & Founder

T: +1 (647) 598-8815

brandon@otisir.com

Reader Advisory

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. In particular, forward-looking information in this press release includes, but is not limited to the expected future performance of the Company, statements concerning the Company's expectations with respect to the Offering, regulatory approval for the Offering, the anticipated use of the net proceeds from the Offering, the receipt of all necessary approvals, including the approval of the TSXV (and the timing thereof), and future plans of third parties, including Omni-Lite. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, governmental regulation, including environmental regulation; unanticipated operating events or performance; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities, including approval for the Offering; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

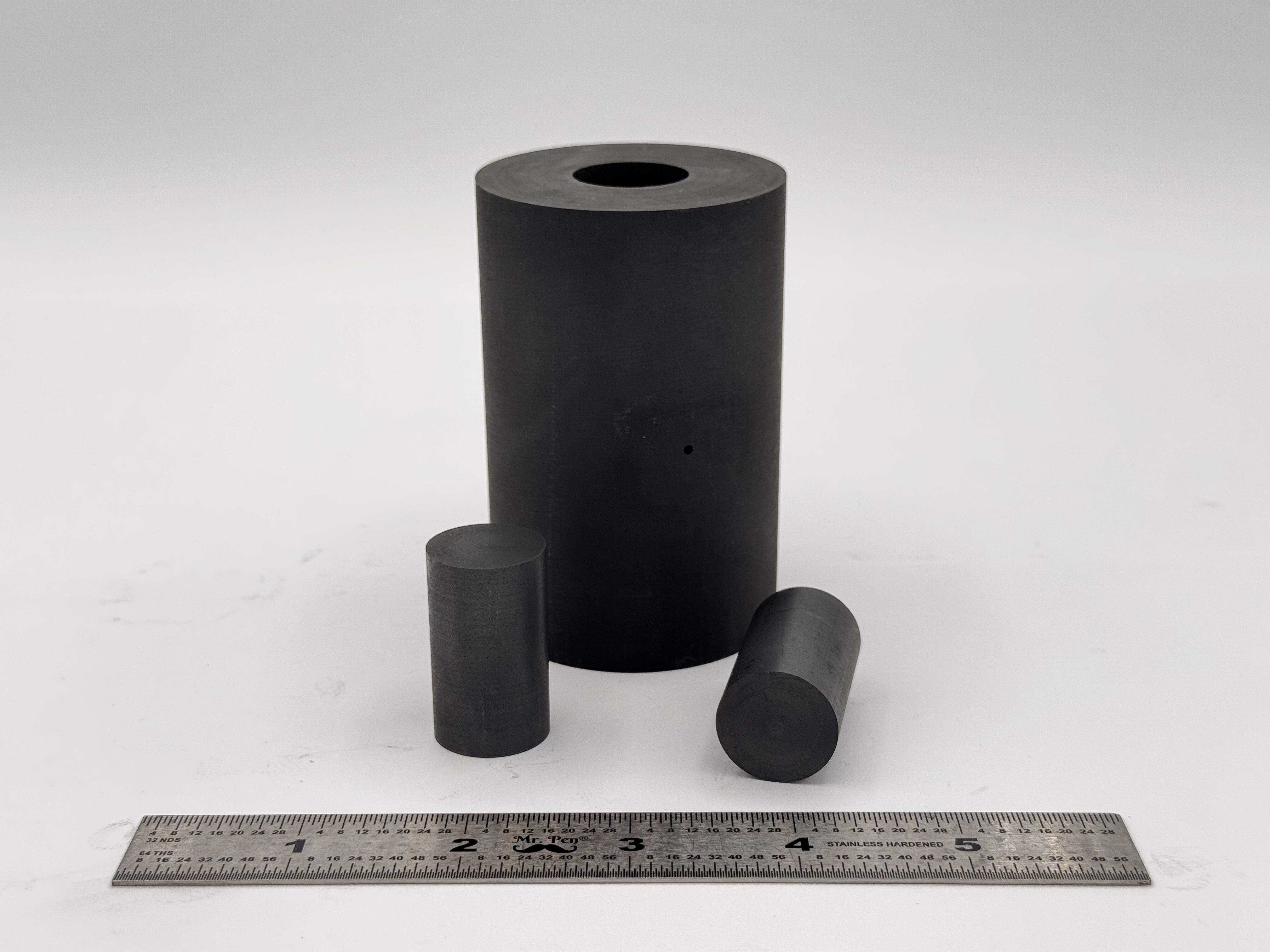

High Strength SPS Graphite Tooling

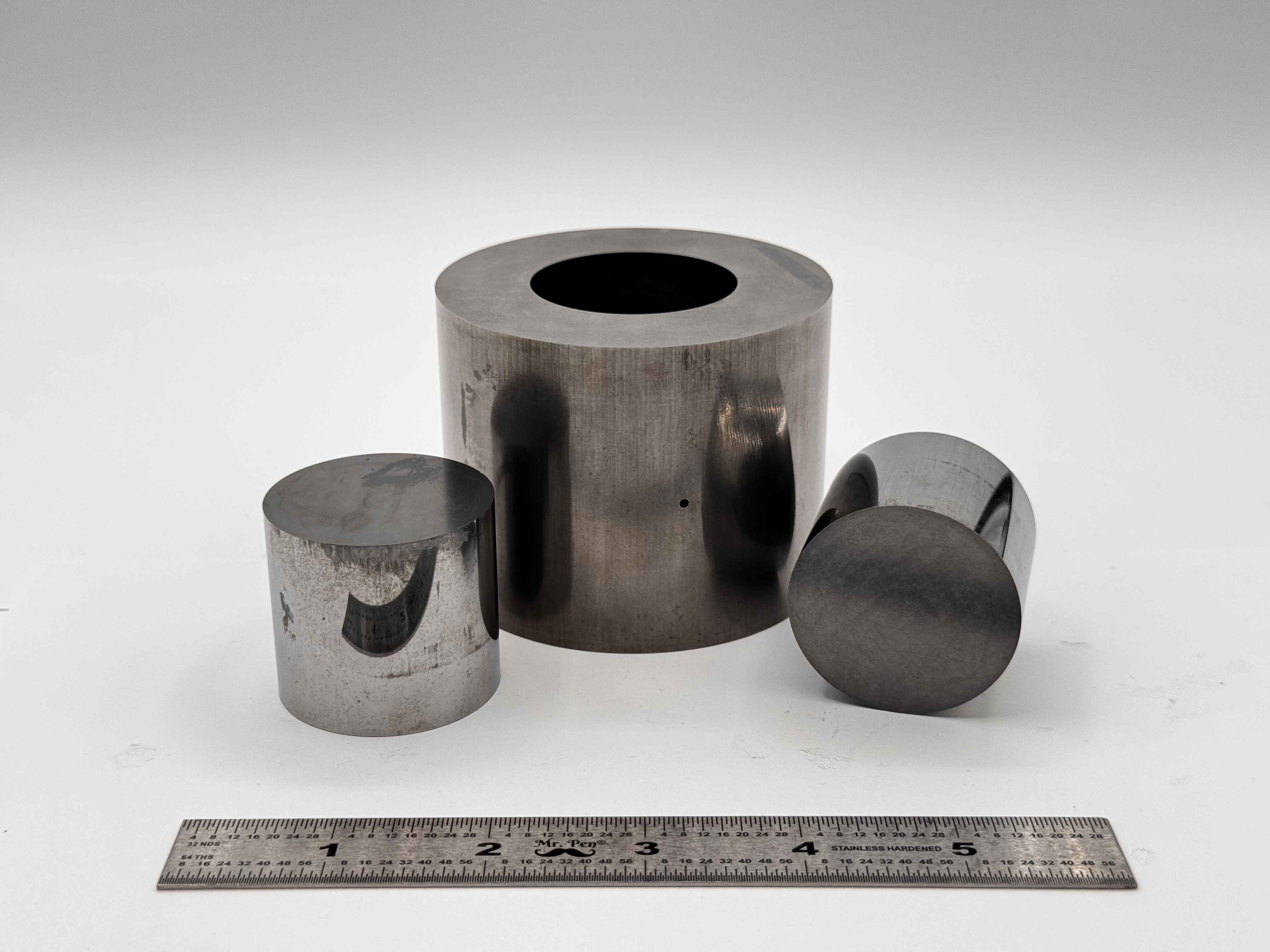

High Strength SPS Graphite Tooling Tungsten Carbide Tooling

Tungsten Carbide Tooling Carbon Graphite Foil / Paper

Carbon Graphite Foil / Paper Carbon Felt and Yarn

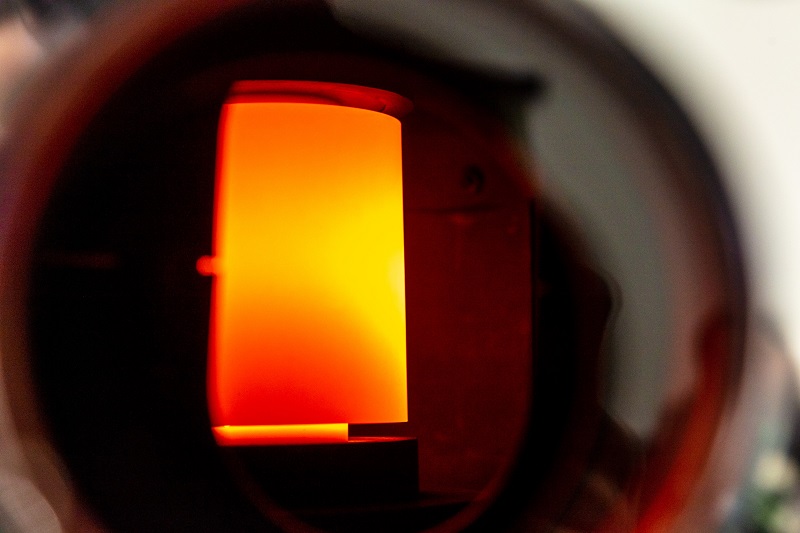

Carbon Felt and Yarn Spark Plasma Sintering Systems

Spark Plasma Sintering Systems SPS/FAST Modeling Software

SPS/FAST Modeling Software